Mark Hammond Jr. with C&T Mortgage Inc. located in Cypress, Texas is committed to helping you find the right mortgage product for your needs.

He understands that every borrower has a unique situation; therefore there are a variety of mortgages to meet each person's individual needs from Government to Conventional, Fixed Rate to Adjustable, and New Construction to Existing Home Loans.

"But that's just the beginning of my service; throughout the lending process I will provide you with weekly updates so you always know the status of your loan."

Mark has built a strong reputation as an outstanding home loan advisor over the last decade serving the needs of Texas real estate professionals, builders and individual home buyers throughout the State.

As a Texas Lender he is licensed in all aspects of mortgage lending including but not limited to Home Equity Loans and Home Equity Lines of Credit. He can also offer 2nd liens.

"We make the process of securing a mortgage simple and straight forward by offering you the latest in financial tools that enable you to make sound financial decisions."

And, now he has chosen to offer all of the exceptional mortgage services online. You not only have the ability to reach him on the weekend or in the evenings, there is also a chat session through this website. You can also be updated with the most recent rates, and even apply for your loan, at your convenience, online - 24 hours a day.

Houston TX VA Home Mortgage Loans

Welcome to the official site of the Texas Mortgage Guy - Mark Hammond. We are a full service mortgage company located in Cypress, TX. We specialize in VA Loans in Houston but handle all types including FHA, USDA and Conventional. We serve all of Texas including San Antonio, Cypress, Tomball, Spring, Houston, Austin, Dallas and Helotes. Whether you are buying a home or refinancing, we can help you realize your dream of home ownership, or help you save money by obtaining a new lower monthly payment. In terms of Purchase Loan Programs, we offer the following:

FHA | VA | USDA | Conventional | HomeReady | Home Possible | Jumbo

Refinancing? We can help you with that, too!

We offer a wide range of refinance options, designed to best meet the needs of local Texas borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs.

FHA Streamline | VA Streamline | USDA Streamline | Conventional | Harp | Jumbo

Contact Mark Hammond today to discuss your options, and find out which program will best suit your needs.

Latest from the Blog

Recent Articles

06

2026

You’ve probably had the same checking account since you were sixteen. Your bank knows your name. Your debit card works everywhere. Loyalty feels safe. But when it comes to a mortgage, that “loyalty” can quietly turn into a convenience fee—and sometimes, a...

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

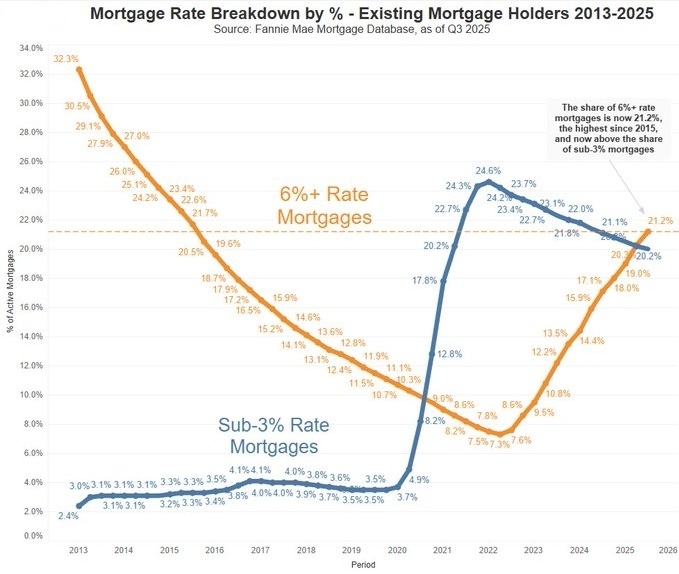

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...